Trusted mortgage broker in Canada.

Personalized mortgage solutions from Pre-Approval to closing. Simple, transparent, and stress-free.

Mortgage PreApproval

- Fast Pre-Approval process

- Know your budget before house hunting

- Strengthen your offer with confidence

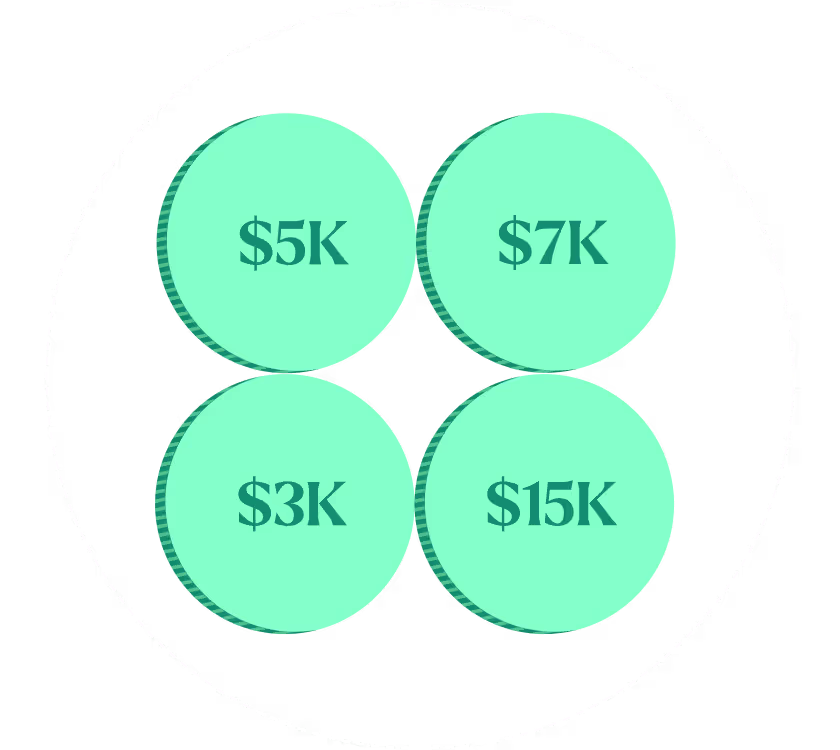

*The 1% down-payment with up to a $7,000 is only for homes under $350,000. The FHA program with 0% down is provided via EPMs Empowered DPA program. To qualify, buyers must have greater than 620 and 580 FICO scores reand income less than 80% of Area Median Income. Closing cost assistance is only for current residents of specific census areas and not income limited.

Check eligibility for assistance

Home Purchase Mortgages

- First-time homebuyers and move-up buyers

- Access to competitive rates from multiple lenders

- Expert guidance through the entire process

Whether you're buying your first home or upgrading to a larger property, we'll help you navigate the Canadian mortgage market. We compare options from major banks, credit unions, and alternative lenders to secure the best solution for you.

Refinance & Equity Take-Out

- Lower your rate or access home equity

- Debt consolidation and renovations

- Competitive refinancing options

Unlock the equity in your home to fund renovations, consolidate debt, or make investments. We'll help you compare refinancing options and find the best solution that aligns with your financial goals.

Explore refinancing

Mortgage Renewal

Get the best rate when your term ends

- Don't automatically renew with your current lender

- Compare rates from multiple lenders

- Save thousands over your mortgage term

A home equity conversion mortgage (HECM) is a FHA insured loan for principal residences of homeowners 62yrs or older. HECMs consume equity and do not require principal or interest payments . Owners are responsible for home maintenace, insurance and taxes.

See your savings

Save money with Everlend

Save money with Everlend

Save money with Everlend

Save money with Everlend

Apply in 15 minutes • Get approved in 24 hours • Close in 15 days

Down payment assistance

- Personalized advice for your situation

- Compare options from multiple lenders

- Unbiased recommendations tailored to you

Access to Canada's top lenders

- Major banks, credit unions & alternative lenders

- Best rates from our extensive network

- Simplified application process

Compare rates from 50+ lenders

- See the “par-rate” with no baked-in costs

- Compare fixed and variable rate options

- Find the best deal for your situation

Full application support

- Guidance through every step of the process

- Help with documentation and paperwork

- Quick approvals and faster closings

Mortgage renewal made easy

- Don't settle for your lender's renewal rate

- We shop the market to save you thousands

- Switch lenders hassle-free at renewal time

Every home has a story

“Maria wanted a home for her daughter. Everlend increased her budget by $30,000 and helped find a $3,800 grant.”

Maria, like many Americans is an immigrant. She serves her community as a "personal shopper" at HEB, a Texas grocery store. Maria is a devoted mom and wanted an affordable home for her small family. After paying nearly half of her income as rent, Maria wanted to buy a home by and build equity. However, high interest rates limited her homebuying budget to $160,000. Maria discovered Everlend through our realtor referral network and used the low rates on offer to elevate her homebuying budget by $30,000. She also received a 2% down payment grant totaling $3,800. At Everlend, we believe in the American dream of homeownership and "affordable mortgages for everyone.”

5-Star Review

“Chad and Tstatsa beat their local credit union's interest rate by 0.5% and used Everlend to transfer their home appraisal through a tricky process.”

Tsatsa and Chad met at UC Santa Barbara while pursuing their PhDs in Chemical Engineering and Computer Security. Chad runs Allthenticate, a security startup that believes “all passwords are weak” and instead helps users store security tokens that unlock everything from computers to physical doors. Tsatsa immigrated from Mongolia an loves spending time with her brothers when she’s not working as a chemical engineer. Chad and Tsatsa purchased their first home in Texas after learning the art of the possible in mortgages with Everlend. Closing day was also Tsatsa's birthday and a new home seemed like the perfect gift.

5-Star Review

“Rob boosted his credit over 50pts to qualify for an FHA loan as a first time homebuyer.”

Rob works for a Swiss security firm and recently transferred to the US. Buying a home with limited credit history can be a challenge, but Everlend's helped Rob and his wife, Melaine, quickly boost their credit and qualify for an FHA loan. It was a dream come true to finally have the space they've always wanted. Melaine also introduced her sister, Tashna, a nurse practitioner to finance her home with great rates and concierge service that every hoembuyer deserves.

5-Star Review

“Casey financed her retirement home, helped her son and several friends buy their dream home with market low rates”

After a lifetime in real-estate, Casey built her dream home in Horseshoe Bay. As with every construction, homes takes longer and cost more than expected. Everlend was able to boost Casey's credit by over a 100 points and provide financing just when it was needed to the most to bring her dream home to life.

After being impressed with Everlend's rates, credit boost, and 15 day closings, Casey introduced several family, friends and clients to get great deals on home ownership.

5-Star Review

Pre-qualify instantly

Upgrade to underwritten approvals in 48 hrs

Instant pre-quals

- Soft credit pull

- Automated DTI calculation

- Self-reported assets

- To preview buying power

Underwritten approvals

- Hard credit pull

- Manually reviewed by an underwriter

- Bank statements collected

- To make guaranteed offers

Close in 15 days

Buying a home is exciting, and we believe financing shouldn’t hold you back. Once you sign initial disclosures, we will help you close in 15 business days or less.

Contract-to-Close Timeline

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Upload a signed contract

Once you upload a signed contract, you’ll receive initial disclosure and your official loan estimate within 24hrs.

Sign initial disclosures

Review all documents and sign your “intent to proceed” and authorization forms so the loan can go to underwriting for approval.

Get conditionally approved

An approval means your are well on your way and have a few remaining conditions to close the loan

Order the appraisal

The appraisal is typically the only thing paid for prior to closing to get an independent value of the home to avoid overpaying

Shop for home insurance

Hazard insurance is essential to protect your home. Select your coverage and we help link it to your mortgage before closing day.

Receive title commitment

A clear title ensures you are purchasing a property free from any liens or encumbrance and you ownership interest is protected.

Satisfy final requirements

We’ll help you respond to any added requests from underwriting such as verification of employment and assets and ensure your rate is locked until closing day.

Read the Closing disclosure

The closing disclosure is received at least 3 days before closing with any updates to terms such as rates, escrow and closing costs.

Get “Cleared to Close”

The “CTC” means no more actions are pending and the loan is ready to enter final balancing with the title company and close.

Congrats, it’s Closing day!

Prepare the funds to close via wire or cashier’s check and review your closing package. Sign all the documents and collect your keys. Congrats on becoming a homeowner! You did it!